Happy Halving

Bitcoin's supply issuance has been cut in half for the fourth time, as it was programmed to do at inception.

Bitcoin’s block subsidy for miners has been ‘halved’ from 6.250 BTC to 3.125 BTC. The halving occurs every 210k blocks mined. A block is mined roughly every 10 minutes, meaning there are ~144 blocks mined each day. Thus, the daily supply issuance has been cut from 900 BTC to 400 BTC.

Historically, the halving has catalyzed a meaningful run-up in price in the proceeding year and change. As we know, history doesn’t repeat itself, but it often rhymes.

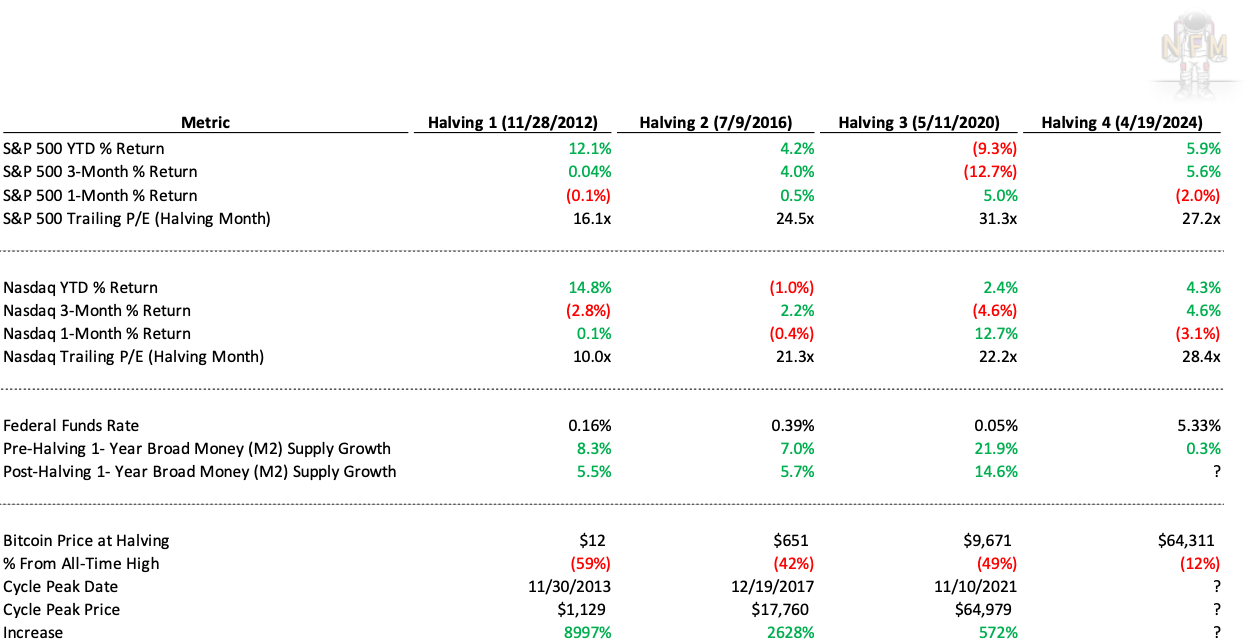

Comparing prior halving market and macro environments, May 2020 takes the cake as the frothiest. The halving coincided with Covid stimulus, emergency rate cutting, and rampant money printing that ignited a bubble-licious bull run. Broad money supply (M2), which reflects the total amount of money available for spending and investment purposes, grew nearly 22% heading into the 2020 halving, and another ~15% thereafter.

This market environment is undoubtedly different, and will be the first real test for Bitcoin outside of the ZIRP era. Inflation is running hot and rates are staying higher in an attempt to combat it. The money printer has been temporarily turned off, as evidenced by M2 supply growing just 0.3% the last 12 months - the slowest rate since Bitcoin’s 2009 inception. Geopolitical concerns have cooled a humming stock market, though the S&P’s TTM P/E still sits comfortably above historical averages at ~27x.

Whereas prior halving bull runs were driven predominantly by retail demand on crypto exchanges, this cycle is shaping up to be fundamentally different. The Bitcoin ETFs were approved and began trading on January 11th of this year. The approvals have increased accessibility to the asset, which is up 32% since approval, and the caliber of the issuers (BlackRock, Fidelity, Invesco, VanEck, ProShares etc.) have de-stigmatized it for a broad base of professional investors.

Per my above table, the halving has never been priced in. Is this time different? I wouldn’t bet on it. Will demand sustain, and what could be new sources of that demand?

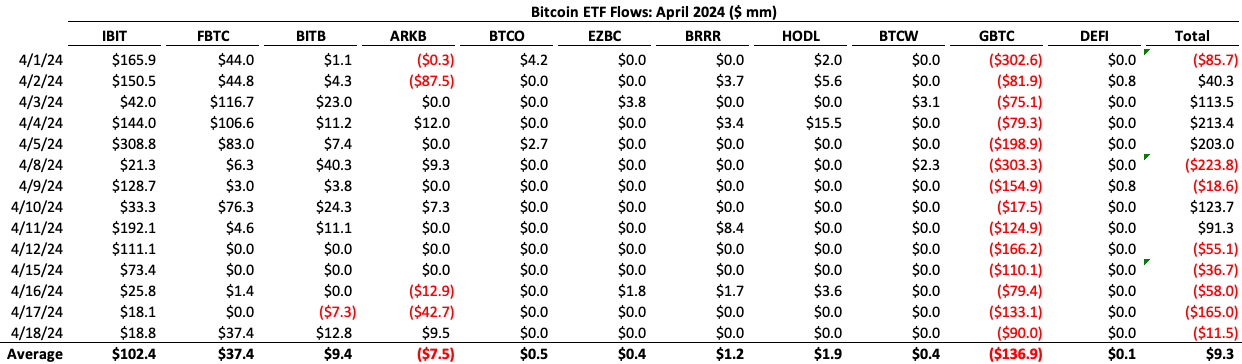

RIA Demand. Earlier this month, BlackRock’s ETF (IBIT) surpassed $15B of total inflows since launch. It has been the most successful ETF launch in history. Thus far in April alone, IBIT has seen average daily inflows of $102mm which equates to 1,625 BTC, or more than 3.5x the 450 BTC that are now being issued daily. And all of this is occurring while Vanguard, the largest brokerage by AUM, continues to prohibit its clients from accessing any of the Bitcoin ETFs.

Grayscale Bitcoin Trust (GBTC), with its 150 basis point fee (vs. most issuers which are charging between 20 and 30 basis points), is currently the albatross in the space. In April, daily outflows from GBTC averaged nearly $137mm, because why would anyone pay 130 basis points more for exposure to the same asset?

There are reasons to believe that ETF demand will not only sustain, but accelerate. First and foremost, the majority of RIAs are now just beginning to work in small portfolio allocations on behalf of their clients.

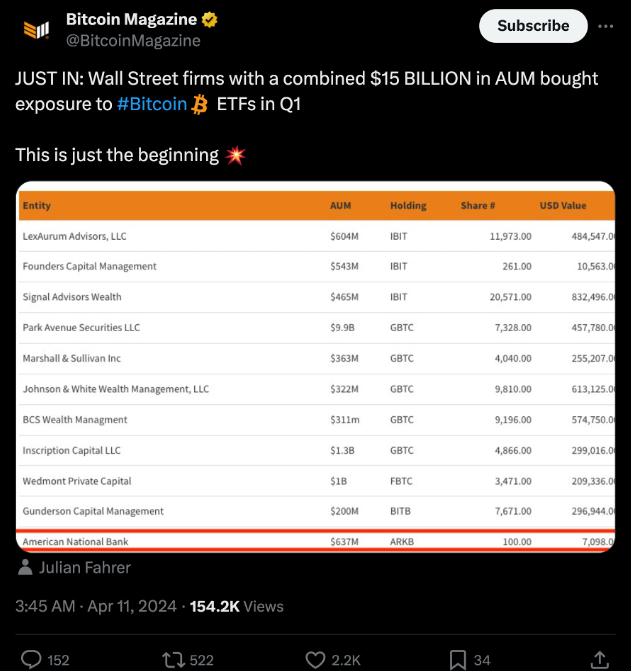

Earlier this month, the first 13F filings since ETF launch revealed small and midsized wealth managers beginning to build positions.

Emphasis on “beginning.” These purchases represent initial nibbles that are rather inconsequential percentages of total AUM. Most of the purchases are <0.10% of AUM; Johnson & White Wealth Management’s $613,125 purchase represents the highest % of AUM at 0.19%.

As Jim Bianco soberly points out, IBIT only has 27 13Fs with more than 10k shares (~$360k), collectively much less than 1% of total outstanding shares.

But, the majority of this contingent are buyers that would have never touched Bitcoin prior to ETF approval, either due to internal restrictions or reputational concerns. Rome wasn’t built in a day. It takes time to do the work, build conviction, and solidify portfolio allocations. The ETFs give RIAs the ability to consistently and compliantly accumulate.

Balance Sheet Demand. The US dollar’s purchasing power has depreciated 25% since 2020. Returns from government bonds and other money market funds that typically comprise treasury reserve assets are not keeping up with inflation. As such, and given the increased accessibility from the ETFs, companies with large treasury balances might convert small percentages of cash earmarked for long-term savings to Bitcoin instead. They should think about these allocations in a similar vein as RIAs on behalf of long-term oriented clients: 1-5% to start.

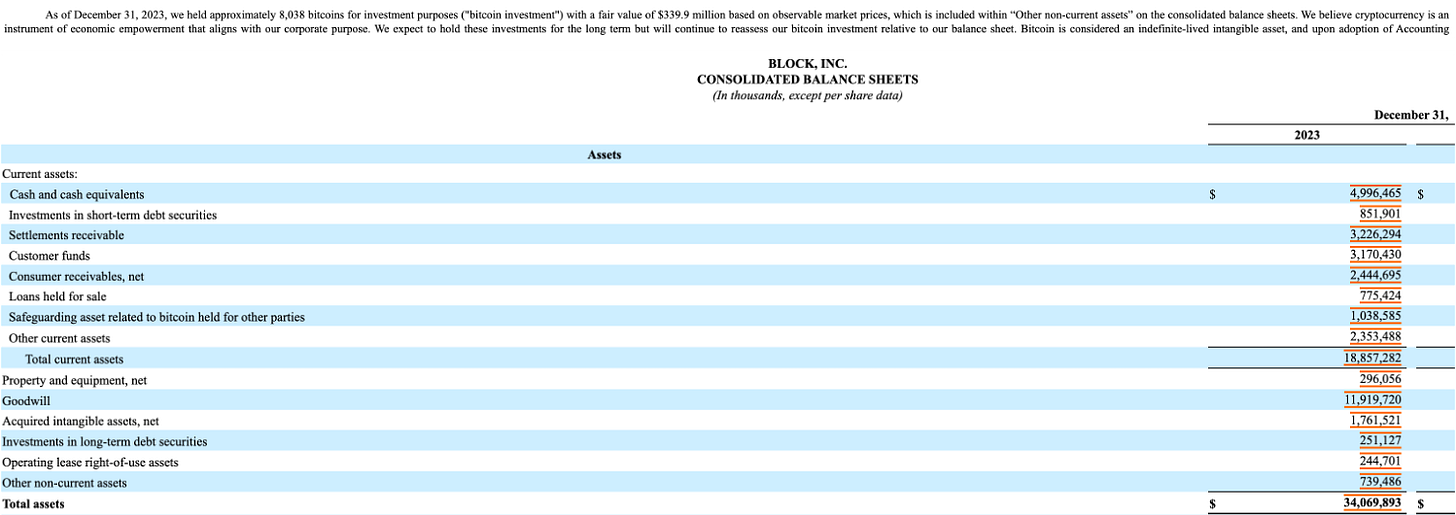

MicroStrategy blazed a trail here, effectively turning its entire business into a levered proxy of Bitcoin with over 214k coins. This is one side of the spectrum. The more actionable path is that of Block, which owns just over 8,038 coins as of the end of 2023. This represented ~$340mm in market value at year end, or 7% of the company’s ~5.0B cash balance. Today, those holdings represent ~$517mm in market value. The company’s 10K delves into its Bitcoin holdings:

As of December 31, 2023, we held approximately 8,038 bitcoins for investment purposes ("bitcoin investment") with a fair value of $339.9 million based on observable market prices, which is included within “Other non-current assets” on the consolidated balance sheets. We believe cryptocurrency is an instrument of economic empowerment that aligns with our corporate purpose. We expect to hold these investments for the long term but will continue to reassess our bitcoin investment relative to our balance sheet.

According to CoinGecko, only 28 public companies hold Bitcoin on their balance sheets. Unsurprisingly, 22 of those companies are in the blockchain and digital asset space. The other six companies - Tesla, Block, NEXON, Meitu, FRMO Corp, and Mogo - have core businesses that aren’t solely focused on the space. This is the more important cohort to follow, and will be the most telling as to whether Bitcoin can gradually evolve into a generally accepted balance sheet asset.

Nation-State Demand. El Salvador began buying Bitcoin in 2021 and owns 5,690 coins as of March 2024. The country also owns a minority stake in a $1B mining farm powered by Salvadoran company Volcano Energy. El Salvador executes a consistent dollar-cost average approach, accumulating 1 BTC per day. In March of this year, El Salvador transferred the majority of its holdings to cold storage housed in a vault within its own borders, a digital Fort Knox if you will. Prior to the transfer, the country was using American company Bitgo for custodial services, which sort of defeated at least one of the purposes of owning Bitcoin in the first place. Of course El Salvador is accumulating Bitcoin as a long-term store of value, but part of the impetus lies in the gradual diversification away from the US dollar.

It has long been theorized that larger and more powerful nation states, especially adversaries of the United States, would begin buying Bitcoin for the same reason (if they are not accumulating already). In 2023, Russia quietly became the second largest mining hub in the world, granting generous tax breaks and even subsidizing mining operations in Siberia. Bhutan and United Arab Emirates have also been public about their state-sponsored mining operations. In 2023, UAE struck a joint venture with miner Marathon Digital to establish two mining sites in Abu Dhabi. It stands to reason that these countries will be the first ones to follow El Salvador’s lead in treating Bitcoin as a treasury reserve asset.

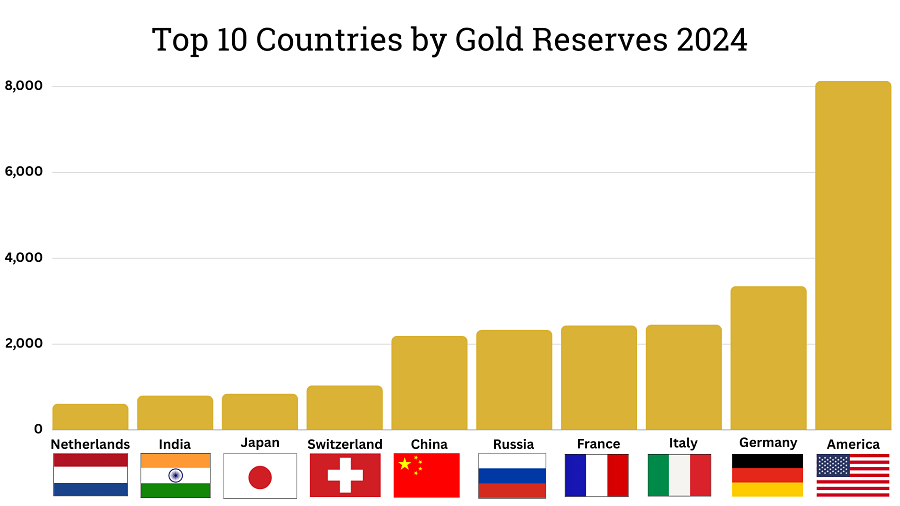

The US government owns Bitcoin through exchange bankruptcies and seizures, but has not publicly indicated any interest in acquiring it as a treasury reserve asset. That said, the US is the largest global holder of gold.

Whether the US will do the work to understand Bitcoin as the modern replacement for monetary gold is anyone’s guess. Political momentum in opposition of Bitcoin suggests this might be a ways off.

Let the game theory begin.