Spotify: Superior Product Seeking Pricing Power

Rabid subscriber usage of Spotify suggests a price increase is warranted. If only it were that simple.

Announced last month, activist investor ValueAct took an undisclosed stake in Spotify. This isn’t ValueAct’s first rodeo with subscription content businesses; the investor took a 7% stake in the New York Times in August of last year. As part of the investment, ValueAct urged management to raise prices on its bundled offering. Prices remain the same, but NYT stock is up 20% since the announcement as of March 23, 2023.

Unlike Trian Partners, ValueAct operates more behind the scenes so we shouldn’t expect a manifesto detailing rationale as Trian did with Disney. But we can make our own guesses.

Cost-cutting recommendations are table stakes with activist investments and Spotify’s situation is no different. Operating expenses accelerated a whopping 44% in 2022. Comparatively, Meta’s OpEx - in its furious crusade to build the metaverse - increased 29% last year. Spotify has already taken measures to reduce OpEx laying off 6% of its workforce in January.

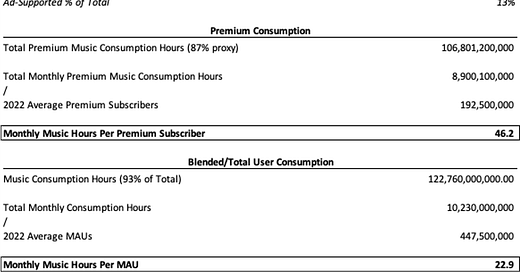

But what about the revenue side? In a prior piece, The Advent of Music NFTs, I argued that streaming has been a “criminally good deal for fans,” especially considering that fans paid, on average, $20 for an album ($34 today, inflation-adjusted) with 10-15 tracks during the physical distribution era. Spotify’s $9.99/mo basic tier is a bargain for subscribers that are consuming, on average, ~46 hours per month.

Granted, the DSP’s strong engagement is due in some part to the fact that music streaming lends itself well to multitasking. People often listen to Spotify passively in the background while they work, exercise, and even sleep (I highly recommend pink noise as an evening lullaby). Social media and SVOD, on the other hand, require a more targeted intent or focused usage.

Despite music complementing many aspects of our lives, we consume it at a deep discount vs. other forms of media.

It’s difficult to reliably compare Spotify to its direct competitors - Apple, YouTube, and Amazon - seeing as audio streaming is merely a small component of their much larger businesses. As such, metrics aren’t consistently reported. But, when paired against indirect comps to measure revenue relative to usage, it becomes clear that Spotify is severely under-monetized on a per-user basis (premium and blended).

Spotify makes just 10 cents per streamed hour, a third of Netflix. This speaks to how undervalued music content is relative to other media. Naturally, this would suggest a price increase, something Spotify has never done for its $9.99 basic tier. By comparison, Netflix has initiated two basic tier price increases since 2019 alone with its price now at $9.99 (up from $7.99 in 2019). Despite both companies having nearly identical pricing and subscriber acquisition strategies in developing markets, Netflix’s gross global monthly ARPU is nearly 3x that of Spotify’s.

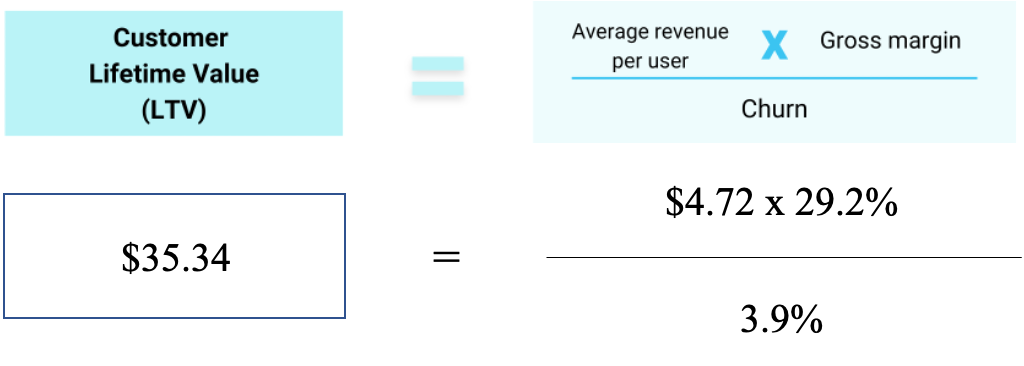

But ARPU is merely one lever in the equation for Spotify’s larger focal point: Lifetime Value (LTV).

Our most recent insight into Spotify’s LTV came in Q4 2021 when the company last publicly reported monthly churn of 3.9%. During this period, the company’s LTV sat at $35.34. Comparatively, Netflix’s LTV during the same period was $185.54, 5.3x higher.

Unlike SVOD libraries which feature different original content, commercial music is commoditized across the major DSPs. Because streaming is a loss leader for large tech competitors, Spotify has less leverage to compete on price - a major constraint in its ability to increase ARPU. And so there is a unique dynamic at play in music streaming where the definitive market leader is beholden to its competitors on pricing.

The company has thus pursued content and product initiatives to bolster the other two levers in the LTV equation: gross margin and churn. Spotify’s aggressive push into owned-and-exclusive podcasts (now more than 500 original shows) has been an effort to differentiate its content offering from other DSPs. Podcasts serve to: 1) level out the marginal cost structure that comes with music licenses and 2) create longer-term pricing power for Spotify in the form of a differentiated library vs. tech competitors. But, pricing power via podcasting has been a slow burn. As of Q1 2022, podcasts only represented 7% of the total listening hours on the platform and were gross margin negative. With this dramatic imbalance - or consumption preference of music over podcasts - Spotify can’t justify a price increase before or beyond competitors.

It’s difficult to imagine Spotify offering an a la carte subscription for its original podcasting content. The platform already enables independent creators to put up paywalls for their podcast content, of which Spotify takes a 5% cut. But, ads are the industry’s dominant model, and favored by larger creators who might scoff at the thought of ostracizing a portion of their audience and corroding long-term ad relationships. Further, there have been attempts at subscription in podcasting, none with the scale that would entice Spotify to follow suit anytime soon. Luminary, the ‘Netflix of podcasting,’ has been a rollercoaster since launching in April 2019 with a $100M war chest. Shortly after launch, the company cut its price by 40%. As of early 2022, the company reportedly had a couple hundred thousand subscribers across platforms’ paying $4.99/mo. Giving them the benefit of the doubt, let’s assume they have 225k subs which equates to approximately $13M in ARR; this is just 6% of the $215M in podcasting revenue that Spotify generated in 2021.

On the product side, Spotify is starting to execute on what I’ve long viewed as its lowest hanging fruit to improve retention: social. Late last year, the company began A/B testing a ‘Friends’ tab that provides an expanded view into friends’ listening habits; sharing songs amongst friends, highlighting tracks on your profile, and group listening parties could soon become a reality. If these new features roll out wide, it will be interesting to see what Spotify then does with its mobile streaming SDK. As I wrote about in From Platform Risk to Protocol Empowerment, there are numerous developers using this SDK to create social listening experiences for their users. Will Spotify spare these developers or shut off access in favor of its own social offering?

On a related note, the company’s dramatic shift to a video-oriented home feed was recently announced with a bevy of features (and to a divisive response).

It’s not inconceivable to imagine some of the more popular new features being bundled into a premium upsell to increase ARPU. Snap launched its Snapchat+ subscription at $3.99/mo. in June of last year which gives subscribers priority replies to celebrities, custom sounds, story expiration controls, and customizable wallpapers. The product eclipsed 1M subscribers in the first 60 days and now boasts 2M+ subscribers as of January 2023. If Spotify can give fans tools to further demonstrate their fandom and potentially increase their proximity to artists in the process, history has shown that people will pay.

Tencent is the poster child for strong monetization of social. The company generates nearly $25 in monthly ARPU from micropayments and virtual gifting associated with karaoke and live-streaming.

Granted, there are significant cultural differences at play in TME’s target markets, but the fact remains that complementary social features can be quite lucrative.

Conclusion

With Spotify, we’ve been getting way too much for way too little…for way too long. And while ValueAct, as part of its investment, may urge the platform to raise prices to 1) reach parity with competitors and 2) more accurately reflect the value of its bundle, Spotify won’t control its own pricing destiny until podcasting and social emerge as more formidable parts of its offering. And until then, both the market price and overall value of the music streaming pie will continue to be dictated by big tech.

Sources

Spotify 2022 Year-End Report (Streaming Consumption, p. 36)

Comscore’s 2022 State of Streaming (Netflix, Hulu, and Disney+ Time Spent)

New York Times Q4 2022 Earnings Release (ARPU)

Spotify Statistics: Users, Artists, Revenue & More - By Matthew Woodard

Spotify Q4 2022 Shareholder Report

Spotify 2021 Podcasting Revenue

Tencent Music Entertainment 2022 Earnings Report

The New York Times Investor Day Presentation (6/13/22)

Spotify Sees Podcast Operating Losses Peaking in 2022 - Variety